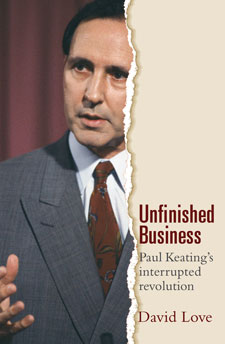

Unfinished Business: Paul Keating’s interrupted revolution is more a book about economics than a political biography; although it is not devoid of biographical detail about Paul Keating.

The author, David Love, ‘a veteran economic and financial observer’, provides us with a survey of Keating’s financial reforms during his time in government, in particular the floating of the Australian dollar and the emergence of compulsory superannuation.

Love also demonstrates how these reforms led to the development of a world class Australian financial-services industry. Many pages of this book are devoted to the emergence of two major players in this industry, the Macquarie Group and the Industry Super Funds.

Love also demonstrates how these reforms led to the development of a world class Australian financial-services industry. Many pages of this book are devoted to the emergence of two major players in this industry, the Macquarie Group and the Industry Super Funds.

There appear to be two main reasons why Love has written this book.

Firstly, he is anxious that the ascent be continued to Keating’s compulsory superannuation contribution target of 15%. This book is, at the very least, a plea to the Rudd Government to finish Keating’s Revolution in this regard.

The main reason that Love gives for the need to reach Keating’s target of 15% is so that our savings can cancel out our borrowings. Love insists that if Keating’s 15% target had been achieved (instead of being halted at 9% by the Howard Government), it is highly unlikely that Australian credit providers would have needed to borrow as much money from the US as they have, and thus Australian exposure to the present American Sub-Prime crisis would have been lessened.

Love is concerned that unless something is done soon, Australia will become more and more vulnerable to global economic forces, one such force being the activities of foreign Hedge Fund traders.

The second reason why Love has written this book is to correct the historical record about Keating. Love is a self-confessed ‘political agnostic’ (p169), not a Labor stooge.

But he is concerned that a myth has been allowed to develop that says that Keating left the Howard Government with “an economy and a set of policies badly in need of repair” (p1). Love argues that, thanks to Keating’s achievements, “Australia was transformed from an imminent candidate for the title of ‘the white trash of Asia’ to a nation whose economy and financial-services industry were the envy of the region” (p1).

As I read Unfinished Business I found myself convinced by its argument about the need to reach Keating’s compulsory superannuation contribution target of 15%. But as I take the words of Jesus into account, I am forced to acknowledge that whilst superannuation can be very helpful in this life, it has no capacity when it comes to securing my future for eternity. Jesus said in Matthew 6:19-20 (NIV):

“Do not store up for yourselves treasures on earth, where moth and rust destroy, and where thieves break in and steal. 20 But store up for yourselves treasures in heaven, where moth and rust do not destroy, and where thieves do not break in and steal.”

Superannuation is good, but only Jesus can provide heavenly treasures which will never be under threat.

Love’s description of the activities of foreign Hedge Funds traders also brought to my mind the words of 1 Timothy 6:10a " "For the love of money is a root of all kinds of evil’.

Out of their desire to grow in wealth, foreign Hedge Fund traders deliberately decimated the economies of countries like Thailand and Indonesia in the 1990s, leaving people in those countries much worse off. Love credits Keating’s reforms, particularly the floating of the Australian dollar, as the reason why Australia didn’t suffer the same fate.

Unfinished Business is for people who are interested in ‘both’ politics and economics. It certainly helped to broaden my understanding of the economic challenges that Australia faces at present and it provides a reasonable solution for what can be done to provide Australia with economic, but not eternal, security.